Introducing Tenderize V2 & our new look!

Introducing Tenderize V2, liquid staking infrastructure comprised of two core protocols: TenderVaults and TenderSwap. These on-chain protocols work together to generate validator-specific liquid staked tokens (LSTs) which collect staking rewards and that can be used in Defi apps.

Introducing Tenderize V2, liquid staking infrastructure comprised of three core protocols: TenderVaults, BeefBank, and TenderSwap. These on-chain protocols work together to generate validator-specific liquid staked tokens (LSTs) which collect staking rewards and that can be used in Defi apps.

Beginning with Polygon, Livepeer, and Graph, proof-of-stake networks are being given tools that offer liquidity to native stakers, kickstarting their LSTfi ecosystem and decentralizing their underlying validator set.

Why Tenderize V2

At Tenderize, we believe it’s possible to have radical decentralization of validators and utility for assets staked to them. Using a validator-specific LST approach of Tenderize v2, proof-of-stake networks can enjoy liquid staking without compromising validator decentralization or censorship resistance.

Demand for liquid staking is on the rise, but there is a major problem - liquid staking solutions of today actively centralize the network’s underlying validator set. When this happens, the censorship resistance of the network is at risk.

Without censorship resistance, there is no guarantee that a third party won’t modify transactions on the network. The immutable and unstoppable attributes which stem from the decentralized validator set drive demand and value for the network's native asset.

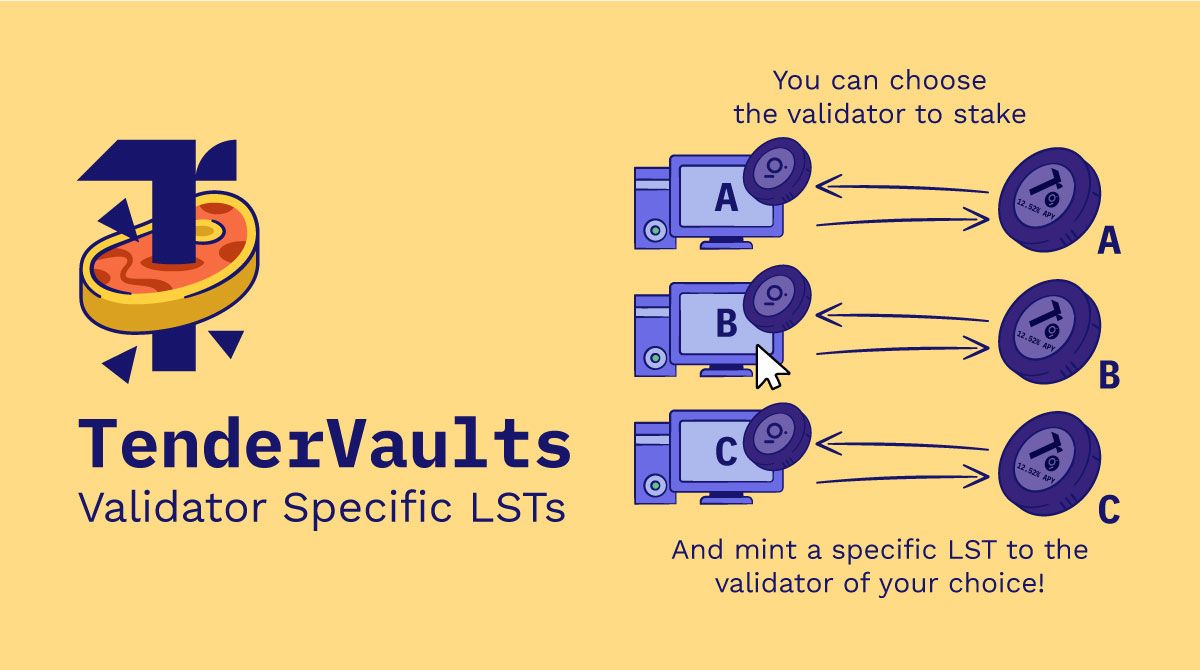

TenderVaults

One part of the Tenderize ecosystem is the TenderVaults - a protocol that mints validator-specific ERC20 tokens representing stake and accrued rewards, called tTokens. Instead of funneling stake to a whitelisted set of validators, users select which validator they want to stake to.

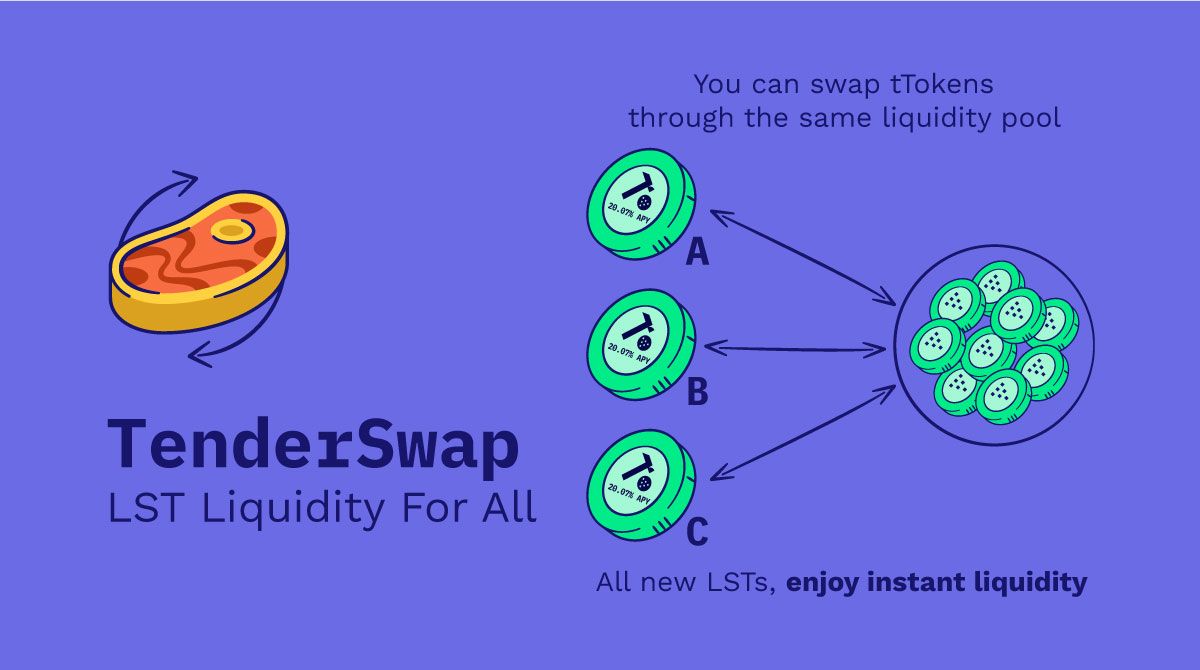

TenderSwap

To ensure there is liquidity for tTokens, Tenderize features TenderSwap: an on-chain liquidity pool ready for tToken swaps. TenderSwap prioritizes liquidity of the unstaked asset, allowing the liquid-staked assets to be swapped for the unstaked asset less a small fee. Depending on the utilization of the pool, swaps will have varying amounts of slippage. As only one side of the pool is incentivized, liquidity costs can be reduced by at least 50%. The result is better swaps with less on-chain liquidity.

BeefBank

Users deposit collateral into BeefBank to mint Steaks Dollar (SD)- an over-collateralized, LST-backed stablecoin. It is the first-of-a-kind decentralized stablecoin backed by a basket of various liquid staked assets. SD is generated by locking in collateral to create a Collateralized Debt Position (CDP). The value of the collateral in a CDP exceeds the value of the debt to prevent liquidation. CDPs don’t rely on external liquidity providers to act as lenders. Creating new debt positions increases the SD supply, where repayment of debt contracts the SD supply.

The yield generated by the LSTs provided as collateral is isolated to their debt position, where it automatically accrues. The owner of the debt then has the option to program the yield:

- Auto-Yield stablecoin (fund yield via tToken - paid as tToken)

- Auto-Yield stablecoin (funded yield by minting SD as collateral value rises- paid in SD)

- Auto-Repaying loan (Yield is sold for SD, paying back the loan)

- Leveraged long (post collateral, mint SD, buy more collateral)

Productive Treasury

The protocol features various fee switches that can be increased or decreased to generate revenue. On launch day, Tenderize will take a small streaming fee on tToken rewards and swaps through TenderSwap.

Accrued revenue is retained by the Tenderize protocol, not distributed to a company or team. The retained revenue is put to work in various yield-generating strategies. These strategies are designed to compound protocol revenue while improving liquidity and user experience for the users. Such strategies include:

- Providing liquidity on Tenderswap

- Creating tToken indexes

- Lending tTokens

- Looping tToken yield

User Benefits

End users receive a version of their staked position, which can be traded, swapped, or used in external defi applications. By staking through Tenderize to the validator of their choice, users enjoy new utility otherwise impossible in the native staking model:

- Instant Exits: Skip the line - no need to wait for the unlock period. This period is 2 days for MATIC, 7 days for LPT 28 days for GRT. By using Tenderize, it’s instant.

- Collateralize tTokens: tTokens can be used as collateral in defi protocols. Coming later this year, users can borrow against their stake, collateralizing tTokens and minting a stablecoin directly via tenderize (coming soon).

Validators and staking providers can leverage Tenderize, offering white-label liquid staking to clients. tTokens isolate risk and delegators aren’t subject to poor performance of other validators in the network. This can be offered to current delegators; no need for delegators to stake to another validator when participating in liquid staking.

WAGYU Token

Linking the ecosystem together is WAGYU, the protocol token. Tenderize is a community-owned and community-governed protocol. Staking WAGYU lets users become active participants in key protocol decisions such as changing the streaming fee, TenderSwap fee, BeefBank borrow fee, and allocation of the productive treasury. In exchange for this service, WAGYU token holders can elect to share revenue from the protocol with token holders in the form of buybacks, burns and distributions.

More details will be released in the coming weeks to describe WAGYU tokenomics. Join our community to stay in the loop and earn the maximum amount of WAGYU from the airdrop.

Join The Movement

Our Discord community awaits, filled with chefs eager to lend a helping hand. Enter the kitchen by using this link.

For more information, check out Tenderize v2 whitepaper, roadmap, and brand kit at Tenderize.me